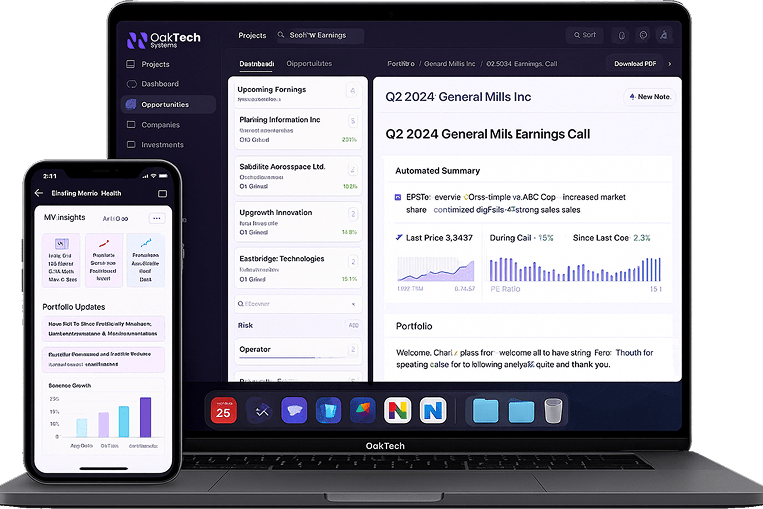

Transforming Capital Markets Through AI Consulting & Incubation

We provide innovative AI solutions and professional services to revolutionize fund management and capital market operations while incubating breakthrough technologies.

About OakTech Systems

OakTech Systems is at the forefront of developing innovative AI models and professional services tailored for the capital markets sector. Our commitment to innovation and excellence positions us as a key player in driving forward the integration of artificial intelligence within capital markets.

Our Vision

To be the leading provider of AI-driven solutions that revolutionize capital markets, ensuring our clients achieve consistent success in a competitive landscape.

Our Mission

To empower Capital Markets with GenAI-powered tools and insights, enabling optimal fund management, risk mitigation, and sustained growth through our proven dual-value-creation model.

Our Four Core AI Solutions

Comprehensive AI-powered solutions designed to address every aspect of capital markets operations

AI Fund Incubation Solutions

Pricing Model:

Setup: $5K-$30K + Monthly: $2.5K-$15K

- Niche investment thesis development

- Optimal funding vehicle selection

- Marketing asset creation

AI Fundraising Solutions

Pricing Model:

Setup: $6K-$36K + Monthly: $3K-$18K

- Investor matching algorithms

- Automated outreach campaigns

- Performance analytics dashboard

Due Diligence Co-Pilot

Pricing Model:

Setup: $3K-$18K + Monthly: $1.5K-$9K

- Automated document analysis

- Risk assessment algorithms

- Market comparison tools

Business Process Assessment with AI

Pricing Model:

Monthly: $6K-$20K

- Process automation design

- AI workflow integration

- Performance optimization

A Self-Reinforcing Growth Engine Built for Fund Managers

Current Projects

$20M+

BUDGET

$50M+

BUDGET

$25M+

BUDGET

$5M+

BUDGET

$100M+

BUDGET

$10M+

BUDGET

$30M+

BUDGET

$50M+

BUDGET

ADU Fund

$20M+

BUDGET

DST Fund

$35M+

BUDGET

$20M+

BUDGET

$50M+

BUDGET

$25M+

BUDGET

$5M+

BUDGET

$100M+

BUDGET

$10M+

BUDGET

$30M+

BUDGET

$50M+

BUDGET

ADU Fund

$20M+

BUDGET

DST Fund

$35M+

BUDGET

Proof of Performance

DDC Venture Success

$12M Valuation

Due Diligence Co-Pilot achieved $2.5M funding at $12M valuation

Fund Incubation Excellence

98% Success Rate

Fundraising Acceleration

65% Above Target

Process Optimization

55% Cost Reduction

Ready to Transform Your Capital Markets Operations?

Get Started Today

Blog

Why Every Modern Enterprise Needs AI Business Process Automation

Visibility Without Velocity Traditional business process analysis provides useful insights but stops short of execution. Teams map workflows, document inefficiencies, and recommend improvements, but the gap between insight and action remains wide. Most organizations end up with static reports and fragmented dashboards that age quickly. The next quarter’s changes in volume, compliance, or customer demand […]

How AI Due Diligence Uncovers Hidden Risks Before the Deal Closes

The Evolution of Due Diligence For decades, due diligence has been the defining step between interest and investment. But the traditional process relies heavily on human bandwidth; that is, analysts cross-referencing spreadsheets, reviewing financial statements, and reconciling fragmented data across systems. This creates latency and bias. Important indicators, such as revenue quality, customer concentration, compliance […]

Fundraising AI: The 2025 Capital Shift

The Data Revolution Behind Fundraising The traditional fundraising process was built on networks and relationships: phone calls, conferences, and incremental relationship building. It worked, but it was slow, opaque, and often biased toward who you knew rather than what you were building. Today, AI for fundraising has turned data into the new form of access. […]

The Evolution of the Hedge Fund Incubator Model: Beyond Seed Capital

What Is a Hedge Fund Incubator? A hedge fund incubator is a cost-efficient, temporary fund structure that enables emerging managers to test and validate their investment strategy using their own capital before raising money from outside investors. Unlike a full-scale hedge fund, which typically requires extensive regulatory filings, compliance frameworks, and a six-figure setup budget, […]