Transforming Capital Markets Through AI Consulting & Incubation

We deliver innovative AI solutions backed by the expertise to transform fund management and capital market operations while incubating breakthrough technologies.

Trusted by top financial institutions, asset managers, and family offices.

$20M+

BUDGET

$5M+

BUDGET

$100M+

BUDGET

$10M+

BUDGET

$30M+

BUDGET

$50M+

BUDGET

ADU Fund

$20M+

BUDGET

DST Fund

$35M+

BUDGET

$20M+

BUDGET

$5M+

BUDGET

$100M+

BUDGET

$10M+

BUDGET

$30M+

BUDGET

$50M+

BUDGET

ADU Fund

$20M+

BUDGET

DST Fund

$35M+

BUDGET

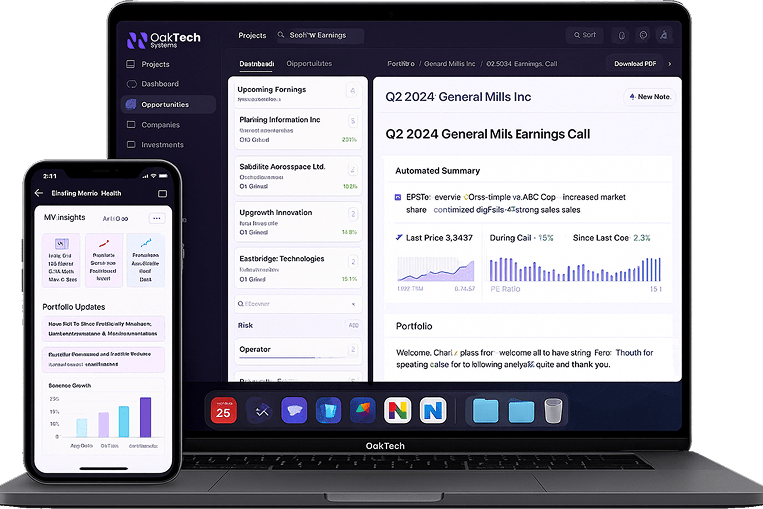

About OakTech Systems

OakTech Systems is at the forefront of developing innovative AI models and professional solutions tailored for the capital markets sector. Our commitment to innovation and excellence positions us as a key player in driving forward the integration of artificial intelligence within capital markets.

Our Vision

To be the leading provider of AI-driven solutions that revolutionize capital markets, ensuring our clients achieve consistent success in a competitive landscape.

Our Mission

To empower Capital Markets with GenAI-powered tools and insights, enabling optimal fund management, risk mitigation, and sustained growth through our proven dual-value-creation model.

Our Four Core AI Solutions

Comprehensive AI-powered solutions designed to address every aspect of capital markets operations

AI Fund Incubation Solutions

Pricing Model:

Setup: $5K-$30K + Monthly: $2.5K-$15K

- Niche investment thesis development

- Optimal funding vehicle selection

- Marketing asset creation

AI Fundraising Solutions

Pricing Model:

Setup: $6K-$36K + Monthly: $3K-$18K

- Investor matching algorithms

- Automated outreach campaigns

- Performance analytics dashboard

Due Diligence Co-Pilot

Pricing Model:

Setup: $3K-$18K + Monthly: $1.5K-$9K

- Automated document analysis

- Risk assessment algorithms

- Market comparison tools

Business Process Assessment with AI

Pricing Model:

Monthly: $6K-$20K

- Process automation design

- AI workflow integration

- Performance optimization

A Self-Reinforcing Growth Engine Built for Fund Managers

Current Projects

$20M+

BUDGET

$5M+

BUDGET

$100M+

BUDGET

$10M+

BUDGET

$30M+

BUDGET

$50M+

BUDGET

ADU Fund

$20M+

BUDGET

DST Fund

$35M+

BUDGET

$20M+

BUDGET

$5M+

BUDGET

$100M+

BUDGET

$10M+

BUDGET

$30M+

BUDGET

$50M+

BUDGET

ADU Fund

$20M+

BUDGET

DST Fund

$35M+

BUDGET

Proof of Performance

DDC Venture Success

$12M Valuation

Due Diligence Co-Pilot achieved $2.5M funding at $12M valuation

Fund Incubation Excellence

98% Success Rate

Fundraising Acceleration

65% Above Target

Process Optimization

55% Cost Reduction

Ready to Transform Your Capital Markets Operations?

Get Started Today

Join Our Growing Team

OakTech grows through talent that thrives in complexity. If you’re driven by impact, precision, and innovation, you belong here.

Blog

Types of Capital: Equity, Debt, Hybrid, Non-Dilutive & Alternative

Equity Capital Equity capital is one of the most widely used types of capital, involving investors providing funds in exchange for ownership in a company or fund. Rather than requiring repayment on a fixed schedule, equity investors participate in the upside through dividends, distributions, or a future exit. Because investors assume greater risk, equity typically demands higher return […]

How Does Capital Raising Work? Understanding the Capital Raising Process

A GP’s Perspective For a GP, the capital raising process is the backbone of every fund launch. It’s the step-by-step path from fund idea to executed LPAs and wired commitments that LPs can clearly evaluate and approve. Allocators experience that process through a few simple questions: Each memo, deck, DDQ, and meeting tells LPs you’re either ready for capital or not. When your strategy, […]

How to Access a Real Estate Investor Network Without Years of Relationship Building

Rethinking the Investor Network Many managers still picture a “network” as a list of wealthy individuals and family offices in someone’s phone. In reality, your real estate investor network is broader and more structured: The goal is not to “know everyone.” The goal is to get efficiently in front of the small subset of investors who are a fit for […]

Capital Raising Services in a Risk-Off Market: How to Navigate Macro Fear

What Defines a Risk-Off Market? A risk-off market is not simply “a downturn.” It is a behavioral shift in how capital allocates. In these environments, allocators prioritize capital preservation over return maximization. Liquidity becomes more valuable. Duration risk is reassessed. Leverage tolerance declines. Investment committees demand clearer downside visibility before approving commitments. You typically see several […]